Our Blog

Innovative Financial Models for Business Jet Operators

12 April 2025

| By Just Aviation TeamThe business aviation sector is navigating a dynamic landscape characterized by fluctuating demand, evolving regulatory frameworks, and increasing operational complexity. Innovative financial models for business jet operators have become essential for optimizing asset utilization, mitigating risk, and enhancing profitability.

Specialized Leasing Models: Balancing Flexibility and Cost

Leasing models in aviation navigate operators the flexibility to scale their fleets while managing costs effectively. Whether through short-term operational leases for immediate needs or long-term finance leases:

Short-Term Leasing (Operational Leases)

Short-term leasing, structured as wet or dry leases, allows operators to access aircraft for specific missions without capital expenditure. For example, a Pilatus PC-24 leased under a wet lease (with crew and maintenance included) enables rapid deployment for ad-hoc medical evacuation flights, bypassing the need for in-house crew certification under EASA Part-ORO regulations:

- Regulatory Compliance: Wet leases require alignment with FAA 14 CFR §91.501 or EASA Part-ORO, ensuring lessors hold valid Air Operator Certificates (AOCs).

- Cost Allocation: Fuel consumption, landing fees, and crew costs are bundled into the lease rate, simplifying budgeting for high-frequency operators.

- Tax Efficiency: Short-term leases in jurisdictions with favorable aviation tax policies may offer VAT exemptions for cross-border operations, reducing overhead.

Long-Term Leasing (Finance Leases)

Long-term leases (12+ months) are ideal for fleet standardization. For instance, a Cessna Citation Longitude acquired via a finance lease allows operators to treat the aircraft as a balance sheet asset while spreading payments over its operational lifecycle:

- Residual Value Management: Financial institutions often include residual value guarantees tied to aircraft utilization (e.g., 400 annual flight hours), incentivizing operators to maintain optimal maintenance schedules.

- Customization: Lessees may negotiate modifications, such as upgrades to advanced avionics systems, to align with existing fleet configurations, minimizing training costs.

Ground Handling Optimization

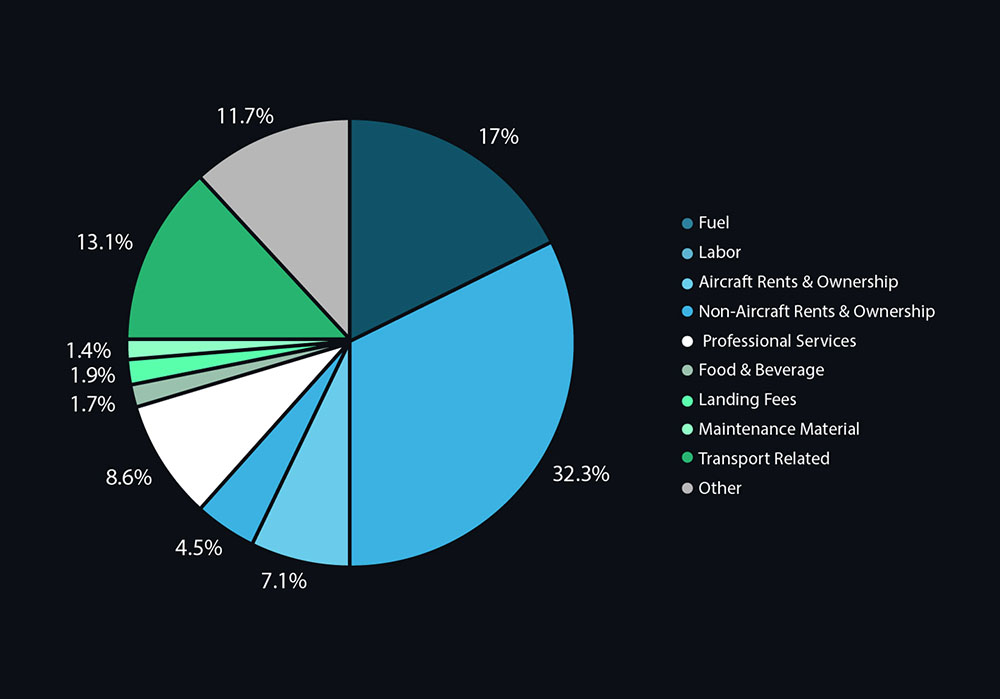

Ground handling expenses account for 15–20% of operational budgets, but dynamic pricing models are mitigating this process;

Global Network Optimization

A robust ground handling strategy relies on a partner with a certified global network of agents, ensuring consistent service quality and cost transparency. For example:

- Case Study: Operators at Aspen-Pitkin County Airport (KASE) mitigate winter handling surcharges by working with partners who pre-position de-icing teams and GPU units, reducing turnaround times by 25% during peak snowfall.

- Unified Billing Platforms: Partners have consolidated impact on invoicing across multiple hubs (e.g., Dubai, Geneva, Teterboro) eliminate administrative overhead, with automated reconciliation against FAA/EASA audit trails.

Risk Mitigation Protocols

- Contingency Resourcing: Partners with redundant GSE fleets ensure uninterrupted operations during events like the Monaco Grand Prix, where Nice Côte d’Azur (LFMN) faces 300% handling demand spikes.

- IS-BAH Certification: Prioritize agents with Stage III IS-BAH certification, guaranteeing adherence to global safety standards and reducing insurance premiums by 8–12%.

Flight Planning: Beyond Route Optimization

Maximizing business jet flight planning relies on financial modeling to optimize costs, from fuel tankering strategies to overflight permit automation. Data-driven decisions reduce expenses, improve efficiency, and enhance operational predictability:

Regulatory-Aware Navigation

Specialists leveraging Performance-Based Navigation (PBN) integrate real-time regulatory updates into flight plans:

- Example: A Challenger 650 avoiding Brazilian ANAC (National Civil Aviation Agency of Brazil)’s newly restricted airspace near Brasília (SBBR) saved 2.2 hours/month by adopting RNP-1 routes pre-approved via partner-provided NOTAM filters.

- Overflight Permit Automation: Providers with embedded diplomatic expertise expedite permits for sensitive regions, reducing permit lead times from 72 hours to 12.

Fuel and Time Criticality

- AI-Driven Tankering Algorithms: Systems analyzing 12-month fuel price trends at destination airports optimize tankering decisions. A Bombardier Global 7500 operator reduced annual fuel costs by $240,000 by tankering from Houston (KHOU) to Europe, guided by partner-provided forecasts.

- Alternate Airport Optimization: Pre-negotiated handling rates at alternates like Shannon (EINN) versus Dublin (EIDW) lower diversion costs by €3,500 per event.

Slot Coordination: Strategic Access and Liquidity

Financial modeling in slot coordination maximizes access and revenue through optimized utilization and strategic trading. From slot arbitrage to pre-blocking for major events, tailored strategies enhance profitability and compliance:

Proactive Slot Portfolio Management

Expertise in slot strategy transforms constraints into opportunities:

- Case Study: A Cessna Citation Longitude operator secured 95% prime-time slots at London City (EGLC) by collaborating with specialists who leveraged historical precedence and IATA WSG loopholes for SME operators.

- Slot Arbitrage: Partners identify undervalued slots at emerging hubs (e.g., Al Maktoum, OMDW) for resale during events like Expo 2030, generating €50,000–€100,000 in ancillary revenue annually.

Compliance-Driven Utilization

- Slot “Banking”: Specialists deploy “ghost rotations” to retain slots at capacity-constrained airports (e.g., Tokyo Haneda, RJTT), ensuring compliance with the 80% usage rule while minimizing operational costs.

- Amnesty Utilization: During FAA slot amnesty periods, partners reallocate unused slots to high-demand routes (e.g., New York to Miami), optimizing fleet utilization by 15%.

Event-Specific Slot Strategies

- Pre-Blocking for Mega-Events: For the Olympics or G20 Summits, specialists secure slots 18 months in advance via diplomatic channels, avoiding last-minute premiums of 200–300%.

- Dynamic Slot Swaps: Real-time trading platforms match operators with complementary slot needs, e.g., swapping a morning arrival at Paris Le Bourget (LFPB) for an evening departure at Geneva (LSGG).

Purchase Financing Programs: Secured Loans and Fractional Models

Asset-Backed Securities (ABS)

ABS structures allow operators to pool aircraft mortgages into tradable bonds. For instance, a $50M loan for a Challenger 650 fleet could be securitized at a 5.5% coupon rate, with investors assuming residual value risk.

Fractional Ownership

EASA’s Part-NCC permits shared ownership, enabling cost-sharing for underutilized aircraft. A Embraer Praetor 600 co-owned by four entities reduces fixed costs by 60% per owner, with a centralized management firm handling maintenance under Part-M regulations.

- Joint Ownership Agreements: Must specify maintenance responsibility ratios (e.g., based on flight hours) and outline exit strategies.

- Tax Implications: VAT exemptions under EU Directive 2006/112 apply if the aircraft is used >50% for business purposes.

FAQs

- How can operators optimize weight and balance constraints in short-term leasing agreements?

Short-term wet/dry leases often impose strict weight limits to protect lessors’ aircraft residual values. Operators must align payloads with the Zero Fuel Weight (ZWF) and Maximum Takeoff Weight (MTOW) specified in the lease. For example, a Pilatus PC-12 NGX leased for medevac missions may cap cabin payload at 2,200 lbs to preserve engine lifespan.

- Technical Mitigation: Use FAA AC 120-27 guidelines to calculate payload-range trade-offs. Pre-load baggage in aft compartments to shift the center of gravity (CG) and maximize fuel efficiency.

- Lease Compliance: Embed weight penalties in contracts (e.g., $500 per pound over limit) and validate via post-flight ACARS data.

- What strategies ensure ground handling efficiency during irregular operations (IROPS)?

IROPS (e.g., diversions, tech stops) require pre-coordinated handling protocols:

- Pre-Negotiated Contingency Rates: Secure fixed fees for unscheduled services at alternates. At Reykjavik (BIRK), a Challenger 605 operator saved €4,200 per diversion by pre-negotiating de-icing and crew transport.

- Automated Resource Allocation: IoT-enabled GSE dispatchers reroute fuel trucks and stairs during delays, cutting turnaround times by 35%.

- Regulatory Compliance: EASA Part-CAT requires handlers to maintain 24/7 readiness at ETOPS alternates. Verify IS-BAH Stage III certification for IROPS hubs.

- How can operators optimize fractional ownership agreements to reduce fixed costs?

Fractional models distribute fixed costs (maintenance, storage, insurance) across co-owners. Key variables include:

- Usage Allocation: Assign costs based on flight hours (e.g., a Pilatus PC-24 shared by 4 owners at 100 hours/year each).

- Exit Clauses: Model buyout terms using discounted cash flow (DCF) to account for depreciation (e.g., 15% annual decline for midsize jets).

- Regulatory Compliance: Align with FAA Part 91 Subpart K or EASA Part-NCC for shared operational control.

- What financial metrics justify transitioning from ownership to a managed charter model?

Compare the internal rate of return (IRR) of ownership (capital costs, depreciation) versus charter revenue potential.

- Case Study: A Bombardier Challenger 650 generating $2.1M/year in charter revenue at 65% utilization yields a 12% IRR, versus 6% IRR under pure ownership.

- Cost Drivers: Factor in management fees (15–20% of revenue), variable maintenance reserves ($1,200/hour), and repositioning costs.

- Modeling Tip: Use sensitivity analysis to stress-test utilization rates (e.g., 50% vs. 75%) and fuel price volatility.

- How do dynamic slot pricing models affect route profitability?

Slot costs at congested hubs (e.g., London Heathrow) vary by ±300% based on demand algorithms.

- Financial Strategy: Deploy real-time bidding tools to acquire slots during off-peak windows. A Dassault Falcon 8X operator saved $18,000/flight by purchasing 23:00 departure slots at 40% below peak rates.

- Compliance: Align bids with IATA WSG Rule 8.5, which prohibits speculative slot acquisition.

- ROI (Return on Investment) Calculation: Compare slot premium against incremental revenue from prime-time client bookings.

Just Aviation leverages advanced financial modeling to help business jet operators optimize hidden operational costs, enhance efficiency, and ensure regulatory compliance. Our expertise covers innovative financial models for business jet operators regarding slot allocations, lease evaluations, and sustainability-driven cost reductions. By providing in-depth technical and financial insights, we empower operators to navigate complex challenges, maximize profitability, and achieve long-term success in a dynamic aviation landscape.