Operational Insights from Busy Winter Routes Between Europe & Middle East

16 December 2025

| By Just Aviation TeamWinter routes between Europe and the Middle East rank among the world’s busiest intercontinental routes. Eurocontrol data for 2024 show high traffic volumes: for example, flights to and from the United Arab Emirates averaged 393 daily flights, a 10.3% rise over 2023 (Egypt was 4th with 356 daily flights).

Understanding Winter Route Constraints

Winter operations between Europe and the Middle East are heavily shaped by three core factors: traffic flows, FIR bottlenecks, and weather-driven corridors.

- Traffic Flows: Southeast Europe, Eastern Mediterranean, Cyprus, Ankara, and Baghdad FIRs often run at capacity in winter, creating route-availability restrictions and possible mandatory reroutes under the RAD (Route Availability Document).

- FIR Bottlenecks: Key junctions (such as Albania FIR → Skopje FIR, Ankara FIR → Baghdad FIR transitions, and the Cyprus FIR upper sectors) frequently experience tactical regulations in winter.

- Weather Corridors: Strong jet streams, winter storms over the Balkans, and dust/sand intrusions over the Middle East can shift operators into narrower corridors, influencing fuel burn and slot compliance.

Beginning winter planning with these constraints helps crews select viable routes before diving into documentation, fuel, or alternates.

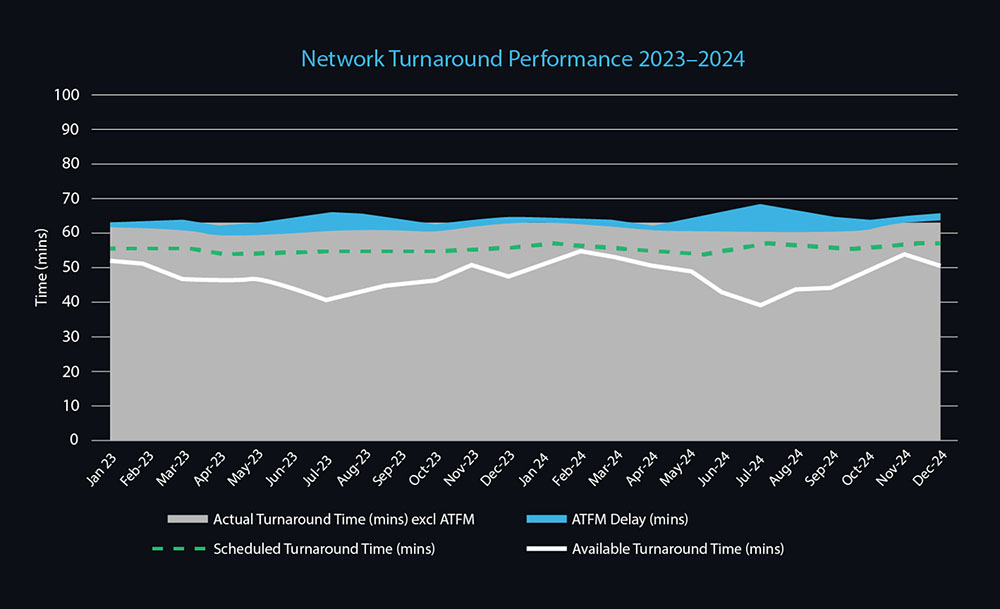

Such high demand often brings ATC delays: in summer 2024 the southeast Europe–Middle East axis accumulated 8.7 million minutes of ATFM delay, of which 45% was due to weather. Operators on these winter routes must therefore plan for congestion and weather delays, allocating extra fuel and flexible slots, and building in buffer time for de-icing, ATC holding or rerouting.

Common Winter Routing Patterns & Alternate Strategy Notes (Europe → Middle East Operations)

During winter, operators often use specific eastbound corridors to avoid RAD restrictions, NOTAM-related capacity limits, and weather-driven flow regulations across Central Europe. The most common options include:

- Via the Balkans: Germany/Austria → Slovenia/Croatia → Serbia → Bulgaria → Turkey. This path is frequently used when Italy, Hungary, or Central European sectors face heavy winter constraints.

- Via Turkey Corridor: Central Europe → Balkans → Turkish FIR → Middle East. The Turkish FIR often remains stable during winter peaks, making it a reliable fallback when RNAV restrictions or lower-level closures appear over Southeastern Europe.

- Via Middle East FIRs: Europe → Turkey → Armenia/Azerbaijan → Gulf. Used when operators want to bypass multiple European flow-regulated sectors, especially during widespread winter weather disruptions.

Alternate Routing Strategy Overview

When winter restrictions impact preferred tracks, operators typically adjust by:

- Shifting early into unconstrained FIRs (e.g., Sofia, Ankara, Tehran) to reduce flow delays.

- Selecting higher or lower ATS routes to bypass temporarily closed levels or RNAV-limited segments.

- Moving east or south earlier to avoid saturated Central European sectors.

- Using Eurocontrol-suggested reroutes, which often provide the fastest IFPS acceptance during winter.

These routing principles support the decision-making applied in the scenarios below.

Planning for Winter Conditions in European Flight Operations

Winter conditions require operators to pay special attention to weather, regulatory compliance and route choice:

Flight and Alternate Planning

Comply with ICAO/EASA rules when filing. If the destination’s weather is below operator minima, file an alternate. EU regs require any alternate’s forecast to show adequate weather; e.g. Category I ILS minima (≥200 ft ceiling above DH and ≥1,500 m visibility) or, if no Aeronautical Information Publication (IAP) exists, ≥2,000 ft ceiling and ≥5,000 m visibility. Operators should brief crews on cold-temperature altimeter settings (airports publish cold-induced altitude corrections in AIPs).

Fuel and Time Reserves

Ensure fuel loads meet regulatory reserves and cover reroutes. As per EU Air Ops, “the PIC shall monitor usable fuel remaining to ensure it is not less than required to proceed to a safe landing”. Plan for additional holding or unexpected winds. If diversions or unexpected delays could bring fuel below final reserve, declare “minimum fuel” to ATC. Many operators pad their winter schedules; Eurocontrol notes carriers have been adding buffers to block times in 2024 to absorb knock‑on delays. Operators should likewise plan extra taxi and holding time, especially in congested winter conditions.

Flight Documentation

Verify all flight paperwork is complete and compliant. This includes up-to-date weight & balance (accounting for any de-/anti-icing fluid weight if applicable), NOTAM briefings for each FIR along the route, and overflight permits for any controlled airspace. File the correct equipment/operational codes in the flight plan (e.g. GPS/RNP authorizations, SATCOM if required) to ensure ATC can clear you on RNAV routes. For cold weather, alternate fuel calculations account for possible enroute speed changes.

ATC and Airspace Considerations

Because Europe–Middle East flights can be long, flight duty time considerations are important. Operators should schedule crews with uplifts for potential delays: if significant ATC waiting time is likely (as Eurocontrol’s 8.7M delay minutes suggests), build in additional rest or consider relief pilots on ultra-long rotations.

Example Scenarios for Operational Efficiency

To illustrate these points, consider the following winter route scenarios. Each outlines a plausible situation and suggests key actions for the operator:

Scenario 1: Short-Notice RAD (Route Availability Document) Change Affecting a London → Doha Flight

It is mid-January. A business jet is scheduled from London to Doha with a preferred routing through Southeastern Europe. The operator finalizes the plan the night before. At 04:30Z (day of flight), Eurocontrol publishes an updated RAD restriction valid immediately due to winter traffic saturation. The new change removes the operator’s planned upper-air route segment:

Required Steps for the Operator

- RAD Re-check: Re-validate the entire field routing against the newest RAD update on the NOP Portal, ensuring any removed segments or newly restricted areas are identified before re-filing.

- ATFM & IFPS Compliance: Update the new route with correct IFPS formatting, confirm required equipment/PBN capabilities remain valid for the revised path, and ensure the system will accept the changes without rejection.

- OFP & Flight Package Update: Issue a revised OFP showing the new track miles, updated fuel planning, and revised en-route alternates, reflecting any weather or winter minima impacts.

Instead of pushing to fight RAD rules, the operator selects a Eurocontrol-suggested alternative route with lower regulation impact. This prevents a CTOT (Calculated Take-Off Time) delay of 45–60 minutes.

Scenario 2: Winter NOTAM Surge Causes Documentation Conflict for a Geneva → Riyadh Flight

On a Sunday morning in February, a Geneva departure is planned. Winter weather across Central Europe triggers a wave of NOTAM updates affecting multiple FIRs. At 07:00Z, the operator discovers that:

- A transition point required for the originally filed route has a new capacity restriction NOTAM,

- Certain lower flight levels are temporarily unavailable due to traffic sequencing regulations,

- And a separate NOTAM introduces a temporary RNAV limitation in parts of Southeastern Europe.

Key Actions Required by the Operator

- NOTAM Filtering: Re-screen all applicable NOTAMs based on State of Origin, en-route FIRs, and alternates, and verify any impact on required minima or route availability under EU rules.

- OFP Revision: Produce a revised OFP reflecting the new routing that avoids restricted RNAV areas, update estimated flight times, fuel load, and reconfirm alternate aerodrome weather and minima.

- ATFM Slot Management: Check NOP Portal regulation rates for the affected sectors, review any potential CTOT assignment, and determine whether submitting a Slot Improvement Proposal (SIP) could reduce expected delays.

The operator files a slightly longer route via an unconstrained FIR to avoid both NOTAM-driven restrictions and ATFM delay. Documentation is reissued accordingly. This reduces dispatch risk and ensures IFPS approval on first submission.

Each scenario highlights specific operational tactics; but common threads emerge. In all cases, pre-flight planning is critical: verify weather, NOTAMs (SNOWTAM, radar coverage, restricted areas), runway conditions, and slot times. Use official guidance for winter operations (ICAO Annex 6, EASA rules or FAA advisories) to set crew procedures. Build contingencies into fuel, alternates, and crew scheduling for ice and delays. By anticipating the challenges of snow, ice and dust on Europe–Middle East flights, business jet operators can keep winter journeys safe and on-time without running afoul of regulations.

FAQs

1. How do winter temperature inversions affect business jet climb performance on Europe–Middle East routes?

During winter, surface-based temperature inversions are common in Europe, especially in early mornings. This traps pollutants and dense cold air near the ground, reducing climb gradient and engine performance in the initial segment. According to EASA CS-25 performance guidance, operators should anticipate a 2–4% climb rate reduction under stable, low-mixing conditions. Adjusting takeoff weight or delaying departure until mid-morning can optimize climb efficiency and minimize engine strain.

2. What coordination is required for Eurocontrol route validation in winter when preferred routes are closed by NOTAM?

Eurocontrol’s Network Manager Operations Centre (NMOC) frequently reroutes flows during winter due to weather, military activity, or reduced staffing. Operators using business jets must revalidate their flight plans via IFPS (Integrated Initial Flight Plan System) at least 3 hours before EOBT. Filing “tactical reroute” requests (CHG or RTE message types) ensures compliance and minimizes ATC slot delay. This is especially critical when southern European FIRs experience convective rerouting or snow-induced sector closures.

3. How do long-range business jets handle winter ETOPS requirements on Europe–Middle East routes?

While many Europe–Middle East city pairs are under 6 hours, long-range business jets (Global, Gulfstream, Falcon 8X) may operate under ETOPS 180 or 240 for optimal routing efficiency. In winter, lower temperatures increase true airspeed but can reduce fuel efficiency.

Operators must revalidate ETOPS alternates to ensure they meet ICAO Annex 6 requirements for usable runways (no contamination, adequate friction coefficient ≥0.3) and weather minima. Seasonal NOTAM closures of alternates (e.g., Mediterranean or Balkan airports) must be crosschecked before dispatch.

4. How does cold-soaked fuel impact refueling operations on quick turnarounds?

When a business jet arrives from a long, high-altitude flight, its wing tanks may retain fuel below 0°C. Refueling immediately afterward can cause condensation and potential fuel icing risk. ICAO Doc 9977 recommends operators wait 20–30 minutes before uplinking new fuel to allow thermal equalization. Additionally, refueling trucks must verify that the fuel temperature differential does not exceed 10°C between tank and delivery hose to prevent icing in wing tanks during subsequent climbs.

5. How are European ATFM (Air Traffic Flow Management) delays mitigated for business jets during winter peak periods?

Eurocontrol’s ATFM allocates CTOT (Calculated Takeoff Time) slots during high congestion. Business jet operators can request “Regulated Flight Exemption (RFE)” under specific categories (e.g., medical, diplomatic, or urgent repositioning flights).

For corporate and charter operations, a “non-scheduled IFR” tag may reduce slot sensitivity if justified. However, filing multiple alternate routings (RPLs) remains the best mitigation tactic—especially in winter when icing or storm fronts cause frequent re-sectorization of Balkan and Eastern Mediterranean airspace.

6. How should business jet operators plan for crew duty limitations during long winter delays?

EASA Subpart FTL defines maximum flight duty periods that can be exceeded only under Commander’s discretion—up to 2 hours extension for unforeseen delays. However, if Eurocontrol GDP or de-icing delays are known before crew report time, extensions cannot apply. For business jet operators, this means preemptively adjusting reporting time or arranging augmented crew for routes exceeding 7 hours during congested winter periods. Proper fatigue management under AMC1 ORO.FTL.110 is required for regulatory compliance.

7. What is the recommended approach to winter contingency fuel planning when alternates have contaminated runways?

ICAO Annex 6 and EASA Part-NCC require contingency fuel sufficient for anticipated deviations. If all suitable alternates are likely contaminated (e.g., snow-covered runways), operators should carry additional “snow contingency fuel”; typically 5–10% beyond standard reserves. The reasoning is that braking action and taxi times increase significantly on slippery surfaces, raising fuel burn on landing and taxi. Dispatchers must also confirm runway condition codes (RWYCC) in SNOWTAMs to refine fuel assumptions during the operational briefing.

Winter operations between Europe and the Middle East require foresight, coordination, and adherence to evolving regulatory standards. From route validations to de-icing logistics, careful planning ensures reliability across challenging conditions. Partnering with our experienced Just Aviation team helps operators navigate seasonal complexities with precision, maintaining seamless connectivity and operational resilience throughout the busiest winter travel months.

Sources

- https://www.eurocontrol.int/sites/default/files/2025-05/eurocontrol-annual-network-operations-report-2024.pdf

- https://ffac.ch/wp-content/uploads/2020/09/ICAO-Annex-6-Operation-of-aircraft-Part-II-International-General-Aviation.pdf

- https://www.faa.gov/other_visit/aviation_industry/airline_operators/airline_safety/deicing/24-25_FAA_Holdover_Tables.pdf

- https://www.faa.gov/documentlibrary/media/advisory_circular/ac_91-74b.pdf

- https://www.eurocontrol.int/publication/eurocontrol-guidelines-cold-temperature-corrections-ats