How Flight Operations Can Mitigate Rising Insurance Premiums

31 October 2024

| By Just Aviation TeamThe aviation industry is experiencing a significant rise in insurance premiums due to various factors such as increased aircraft repair costs, higher liability claims, and a more litigious environment. For smaller flight operations, these rising costs can be particularly challenging. However, there are several detailed strategies that can be employed to mitigate these increases and manage insurance expenses effectively.

Understanding the Factors Driving Insurance Premiums

To effectively mitigate rising insurance premiums, it is crucial to understand the underlying factors:

- Increased Aircraft Repair Costs: Modern aircraft are equipped with advanced technology, making repairs more expensive. The integration of composite materials and sophisticated avionics systems has driven up the cost of parts and labor.

- Higher Liability Claims: The aviation industry faces higher liability claims due to accidents and incidents. The increase in passenger traffic and the complexity of modern air travel contribute to higher potential liabilities.

- Regulatory Changes: New regulations often require additional compliance measures, increasing operational costs. Compliance with international standards such as ICAO and EASA regulations can be costly.

- Market Conditions: The insurance market is cyclical, and current conditions have led to higher premiums. Factors such as natural disasters, economic downturns, and geopolitical instability can influence market conditions.

Strategies for Mitigating Insurance Premiums

Implementing these advanced technical and operational strategies enables business flight operators to mitigate rising insurance premiums effectively:

1. Implementing a Safety Management System (SMS)

An SMS provides a comprehensive framework for incorporating safety protocols into all operational facets, encompassing policy development, hazard identification, risk management, safety assurance, and ongoing safety promotion. Effective SMS implementation leverages data analytics to detect safety trends and applies predictive methodologies to mitigate risks.

- A business jet operator implements an SMS by integrating a cloud-based safety management software suite across its operations. The system enables flight crews, ground personnel, and maintenance teams to submit safety reports and hazard observations in real-time via a secure mobile interface. Advanced data analytics tools then assess these inputs to identify recurring patterns, such as discrepancies in avionics systems or specific maintenance procedures. This allows the operator to address these issues proactively, updating Standard Operating Procedures (SOPs) and conducting targeted maintenance interventions to prevent future occurrences.

Business aviation insurance premiums have seen significant increases, with most claims-free business and commercial general aviation operations experiencing 15-30% average annual rate increases from 2019 to 2021. Single-pilot and owner-flown turbine operators were among those hardest hit.

2. Adopting Advanced Technology

The deployment of cutting-edge avionics, predictive maintenance systems, and flight data monitoring tools significantly enhances operational safety and efficiency. Technologies such as Flight Operational Quality Assurance (FOQA) and Aircraft Communications Addressing and Reporting System (ACARS) are integral to monitoring real-time aircraft performance data.

- A business flight operator incorporates FOQA and ACARS systems into its fleet to continuously monitor aircraft performance metrics such as engine health, flight envelope deviations, and structural load exceedances. This data is used to optimize maintenance schedules and anticipate component failures. The operator also integrates an Electronic Flight Bag (EFB) system that provides pilots with real-time weather updates, NOTAMs, and performance calculations, enhancing situational awareness and operational decision-making.

3. Optimizing Fleet Management

Effective fleet management involves strategic decisions based on the aircraft lifecycle, utilization patterns, and evolving maintenance needs. This requires conducting routine Maintenance Steering Group-3 (MSG-3) analysis to optimize inspection intervals and ensure compliance with Continued Airworthiness Management Organization (CAMO) standards.

- The business jet operator conducts a comprehensive fleet evaluation using MSG-3 methodologies, identifying aircraft that have reached a maintenance-intensive phase of their lifecycle. The operator decides to retire older aircraft equipped with legacy avionics and replace them with newer models featuring advanced noise-reduction technologies and fly-by-wire systems. In parallel, they introduce a data-driven reliability program that adjusts maintenance schedules based on real-time aircraft usage data, thus reducing unscheduled maintenance and maximizing dispatch reliability.

4. Engaging with Specialized Insurance Brokers

Collaborating with brokers who specialize in aviation insurance provides access to tailored coverage solutions. Brokers can negotiate premium reductions based on the operator’s adoption of risk mitigation technologies, participation in industry safety audits, and adherence to international safety standards such as the International Standard for Business Aircraft Operations (IS-BAO).

- The business flight operator partners with a broker who specializes in corporate aviation insurance, conducting a risk assessment based on the operator’s IS-BAO registration, pilot qualifications, and the implementation of onboard safety enhancements such as TCAS II and Runway Awareness and Advisory Systems (RAAS). The broker negotiates an insurance package that includes premium discounts for participating in third-party safety audits and implementing fatigue risk management systems (FRMS), resulting in more competitive insurance terms.

5. Risk Assessment and Mitigation

Comprehensive risk assessments for business aviation require sophisticated risk modeling techniques, such as probabilistic risk assessments (PRA) and Monte Carlo simulations, to quantify the likelihood of operational hazards. This process includes evaluating hazards associated with flight routing, airport suitability, and operational environment variables such as terrain and air traffic density.

- A business flight operator conducts an advanced risk assessment using probabilistic risk modeling to evaluate potential hazards on frequently traveled routes. The analysis identifies high-risk factors associated with operations in mountainous regions, such as sudden weather changes and CFIT (Controlled Flight Into Terrain) risks. The operator mitigates these risks by implementing terrain awareness training for pilots, equipping aircraft with Enhanced Vision Systems (EVS), and developing contingency plans that include predetermined escape routes and diversion strategies.

6. Reviewing Insurance Coverage Regularly

Regular insurance policy reviews allow business flight operators to fine-tune their coverage based on changing operational risks and regulatory requirements. This includes examining coverage limits for high-value assets, updating liability coverage for charter operations, and ensuring compliance with any new safety regulations or international agreements such as the Montreal Convention.

- A business aviation operator reviews its insurance policy annually, focusing on aligning coverage with its fleet expansion and international charter operations. The review identifies the need to increase coverage for high-value aircraft operating in regions with elevated geopolitical risks. Additionally, the operator secures coverage for expanded operational risks, such as extended-range business jet operations (ERBJ) across remote oceanic regions, where specialized search and rescue services may be required.

Navigating Rising Insurance Costs in Business Aviation

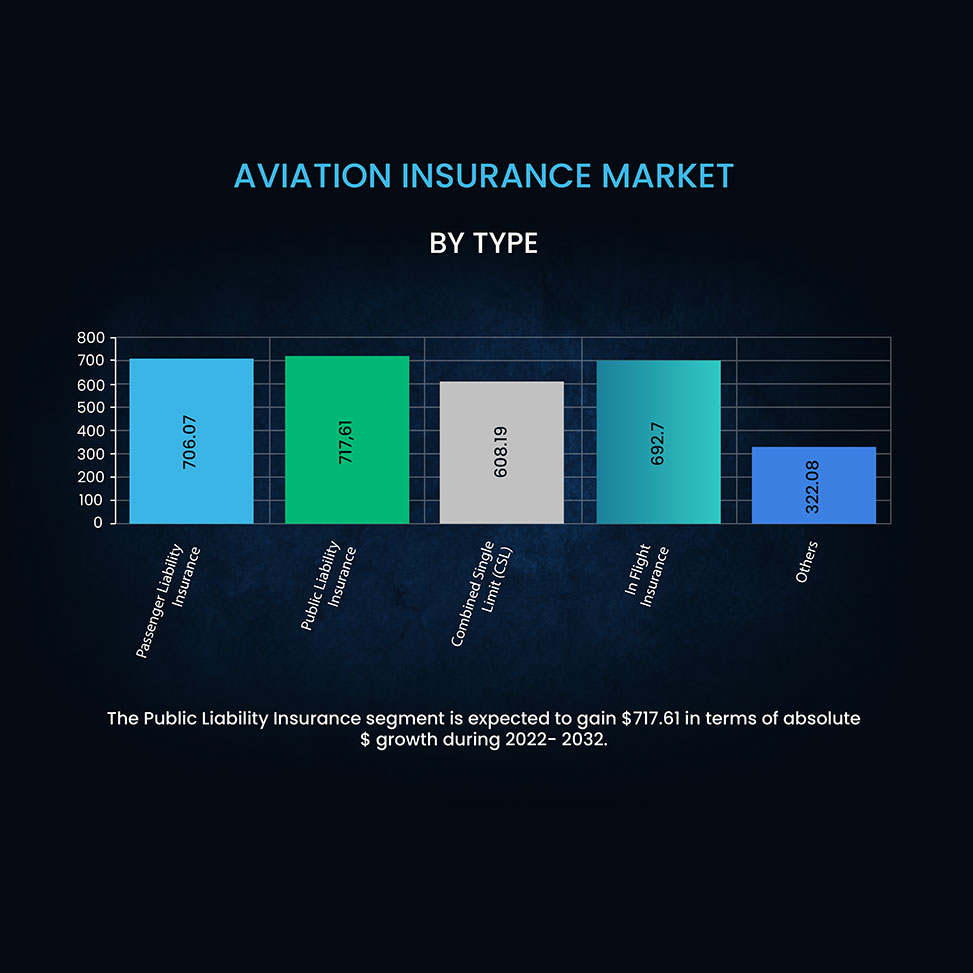

Despite the recent challenges in rising insurance premiums for business aviation, operators have opportunities to proactively manage these costs. While premiums have seen an average annual increase of 15-30% from 2019 to 2021, the sector’s resilience and focus on safety can help offset these pressures. Business aviation accounts for approximately 43.3% of the $6 billion global aviation insurance market, positioning operators to influence premium trends through effective risk management. By implementing comprehensive safety strategies, operators can not only improve safety outcomes but also potentially access more favorable insurance terms.

The proactive adoption of advanced safety management systems, predictive maintenance technologies, and rigorous risk assessment methodologies can lead to reduced claims and enhanced operational efficiencies. As insurers seek to reward lower-risk profiles, operators that demonstrate a commitment to safety excellence are well-positioned to negotiate competitive premium rates. Furthermore, leveraging new technologies to minimize maintenance costs and streamline operations can help contain expenses, even as premiums approach a 20-year high.

Ultimately, by embracing innovative approaches to safety and operational efficiency, business flight operators can turn the challenge of rising insurance costs into an opportunity for growth. Demonstrating proactive risk management not only enhances insurer confidence but also supports sustainable long-term operations, ensuring that the sector continues to thrive amidst an evolving insurance landscape.

Just Aviation’s business flight support services are designed to help operators navigate rising insurance costs through tailored safety and risk management solutions. By implementing advanced Safety Management Systems (SMS), predictive maintenance programs, and rigorous risk assessment methodologies, Just Aviation ensures optimized operations and reduced claim risks. Our comprehensive approach allows operators to maintain high safety standards while negotiating competitive insurance terms, ultimately supporting sustainable and cost-effective business aviation.